There is a kind of rumor that dies down in a matter of days and the kind that lives throughout centuries and becomes reality. So has proven the catchphrase “the rich get richer and poor get poorer” in Latin America. Although the last decade succeeded in large reductions of extreme poverty, one in every five people continue to live in extreme poverty (Meza), while the region’s billionaires see a 21% growth in their wealth per year. If this were to persist, the top richest 1% would soon earn more than the other 99% of the population (Ibarra). Evidently, high levels of income inequality caused by both natural and artificial proceedings have contributed to increasing poverty, severely impacting the region’s inclusive economic growth and prosperity.

Nevertheless, there is quite an influential group of the wealthy elite and economists that seek to justify the fairness of income inequality. Bringing to light the tradeoff between efficiency and inequality, the wealthy class argues that higher income inequality creates incentives for productivity, entrepreneurship, innovation, and job creation, resulting in higher living standards for all social classes. The political economics editor of Real Clear Markets John Tamny states, “the free market is about turning scarcity into abundance… income inequality makes what once seemed like impossible luxuries available to almost everyone (Morse).” Instead of attempting to make the unpractical economic pie with equal slices, why not let the richer flourish and enlarge the slices of the pie? Why should we care if everyone is better off (Winship)?

The truth is this issue is not as simple as the more affluent individuals make it sound. Competition featured in capitalism is essential for an efficient economy, however, it is important to acknowledge the facts and theories, recognizing the existence of distortions in the market and the greater implications of income disparity on a more social and macroeconomic scale in the long-run (Dabla-Norris).

Equality is a meaningful moral for the common citizen. On that account, when we realize that Latin America’s billionaires grow wealth that is six times higher than the region’s GDP annually, and that they contribute to only 5% of taxable income in addition to the disheartening rates of tax evasion, we naturally have a tendency to feel offended and even robbed (Ibarra). Income inequality not only creates barriers to poverty reduction but hampers economic growth by leading a chain reaction where the lower income class lacks opportunity to invest in human capital that would increase labor productivity. According to the IMF, the outcome of high income disparity are greater financial instability and policies that suppress growth. Furthermore, the growth of the economic pie is less efficient where high levels of income inequality already exist (Dabla-Norris).

The causes of income inequality are interpreted within two different market structures: the perfectly competitive market and the imperfect market. In the first category, the marginal productivity theory of income distribution explains that “the price paid for all factors in the economy is equal to the increase in the value of output generated by the last unit of the factor employed in the market (Krugman, 711).” In other words, it states that the income that individuals earn are a direct reflection of their productivity in terms of the value of output they provide. The logical reasoning behind the theory is revealed through the concepts of compensating differentials, differences in talents, and differences in the amount of human capital. For instance, we would agree that a truck driver carrying a hazardous chemical deserves a higher wage than one carrying furniture and likewise, stuntmen should be paid more than a regular actor in a movie. This illustration of compensating differentials demonstrates that in general the element of a dangerous job-setting results in a higher pay than other workers with the same abilities but in more pleasant conditions (Krugman, 712).

The second cause for income inequality in the context of the marginal productivity theory is differences in talents. Every individual is unique and possesses different capabilities that engender varying levels of productive potential (Krugman, 712). For example, we know that practice is the path to improvement, but a great percentage of people are inclined to prefer and be better in a certain field as Mozart and Beethoven were in music and as the tech-savvy may be in implementing cybersecurity facilities.

Lastly, the most crucial cause that the marginal productivity model emphasizes is differences in the investment and quantity of human capital. Education, training, and experience are vital in determining the level of productivity. According to the Bureau of Labor Statistics, individuals with a high school diploma earn more than those without one, and those with a college degree are able to receive a higher income than those with only a high school diploma (Krugman, 713). An SAT tutor with 20 years of experience is able to claim more payment than someone who is an amateur, while surgeons and doctors are able to perform their tasks with ease due to their background of human capital accumulation. Globalization and evolving technology are key phenomenons of growth that increasingly demand a skill-intensive economy, increasing the gap between the wages of the high-skilled and low-skilled workers (Dabla-Norris).

The validity of the marginal productivity theory is contradicted in the imperfect market structure. This model identifies market power, efficiency wages, and discrimination as the root of income inequality. When firms have market power, they are able to maximize profit by establishing lower wages that often do not equate the productivity of output generated by an individual. As a result, workers organize unions as a collective bargaining method to demand higher wages. Thus, in the presence of market power, the philosophy of income distribution that benefits the profit-maximizing firm widens the gap between the rich and the rest of the social classes (Krugman, 713). Additionally, the market failure-induced efficiency wage model that strives to boost wages above the market equilibrium in order to increase performance and loyalty, result in a surplus of labor followed by unemployment as there are more workers searching for efficiency-wage jobs than there exist (Krugman, 714).

In Latin America, income inequality driven by discrimination in ethnicity and gender persist. Racial and ethnic minorities such as the indigenous population earn considerably less than the average population (Morrison), while women earn 25.6% less than males for the same job and production according to the Economic Commission for Latin America and the Caribbean (Herald Staff).

Another source of great controversy have been offshore tax havens. The leakage of the Panama Papers in April 2016 increased criticism towards low tax jurisdictions as it reaffirmed the corrupt practices of money laundering and tax evasion by wealthy individuals, including corporation owners, public figures, and politicians worldwide. It was estimated that approximately US$21 to US$32 trillion were stored in offshore financial centers, allowing mostly the wealthy elite to hide assets and avoid taxation. Consequently, it was discovered that there was US$189 billion in lost revenue per year that could have been used to improve welfare programs and lighten the burden of full tax brackets on the middle and lower class (Christopher Matthews).

The effects of income inequality are evident, and solutions are hotly debated. Although Latin America is not the poorest region, it is the most unequal in the world by 30% more according to the Gini coefficient scale (zero representing equal income for everyone and 1.0 being when an individual has all income) (Lustig). Moreover, IMF studies constantly show the correlation between inequality reduction and higher growth with the enabling of poverty reduction (Dabla-Norris). In the year 2000, the percentage of the extreme poor lowered to 12% from 25%. This poverty reduction was largely because of economic growth, but 40% was due to inequality reduction (Lustig).

There will never be a single solution that addresses the problem of income inequality as each sovereign nation faces different situations. However, some of the solutions that are constantly being proposed are income redistribution, minimum wage policy reform, improving tax compliance through the elimination of financial secrecy in offshore tax havens, and fostering inclusive growth.

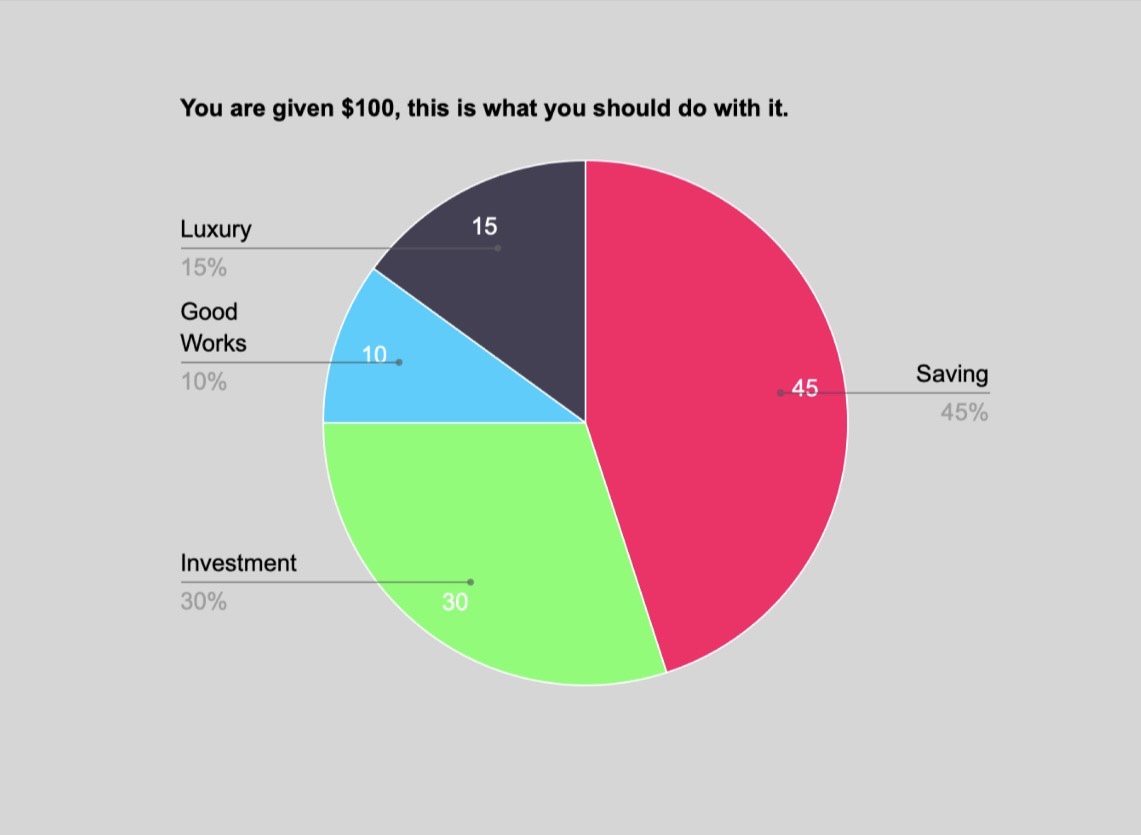

For decades, the idea of income redistribution has been controversial for two reasons: the extent of government intervention and the tradeoff between efficiency and equity. Many believe that although poverty reduction and protection from financial crises are legitimate reasons, the government’s role should be limited to enforcing the law and providing national defence rather than interfering in the free market economy. In addition, many associate income redistribution and anti-poverty programs with a tradeoff for higher tax rates. The improvement of welfare programs would come at the expense of higher tax rates of progressive nature that would lower the purchasing power of citizens and reduce incentives for savings and investment. On the other hand, it would benefit the lower class and potentially lift them out of poverty (Krugman, 771-772).

Another approach to reducing inequality has been reforming the minimum wage policy. In Mexico, minimum wage was set at US$3.78 a day in the year 2015, which meant that individuals who earned this amount had to work for over 37 days to reach the standards of monthly “well-being” established by their government (Woody). According to the IMF and empirical data on nations such as Brazil and Argentina, the increase in minimum wages has led to reductions in income inequality (Lustig).

Furthermore, there are currently an international anti-tax competition campaign and projects being developed to enhance the transparency of offshore jurisdictions through the elimination of financial secrecy. The OECD and the G20 have been leading international tax cooperatives through multilateral agreements that would ensure the low tax jurisdiction’s commitment to share information on tax matters such as data on the beneficial owners of shell corporations and bank accounts upon request (Vermeiren).

Lastly, inclusive economic growth is the most essential approach. As technology continues to develop and globalization accelerates, it is important to foster financial inclusion by enabling equal access to quality education for all, which not only includes primary education but secondary and tertiary levels as well. Many unskilled workers resort to informal labor because they have no choice. Lack of opportunity and access hold them back from accumulating human capital. As a result, their jobs are not rewarding enough for a stable living, and those who barely surpass the poverty line are vulnerable to slipping back on occasions of recessions or financial instability (Dabla-Norris).

In conclusion, it is important to recognize the interrelation between income disparity, economic growth, and poverty reduction. Latin America is the world’s most unequal region, and the controversy regarding possible solutions will remain as every society, culture, and citizen has differing morals and opinions on the opportunity costs that each solution entails. However, if the region develops strategies that balance efficiency and equity, and nations analyze their specific situation of income distribution, it will reap positive outcomes. Reducing income inequality reduces poverty and opens the way to inclusive growth and prosperity.

Works Cited

Christopher Matthews. “The Real Problem With Offshore Tax Havens.” Time. Time, 26 July 2012. Web. 31 Mar. 2017. <http://business.time.com/2012/07/26/the-real-problem-with-offshore-tax-havens/>.

Dabla-Norris, Era, Kalpana Kochhar, Nujin Suphaphiphat, Frantisek Ricka, and Evridiki Tsounta. Causes and Consequences of Income Inequality:A Global Perspective. N.p.: International Monetary Fund, 2015. International Monetary Fund. June 2015. Web. 30 Mar. 2017. <https://www.imf.org/external/pubs/ft/sdn/2015/sdn1513.pdf>.

Herald Staff. “Gender Wage Gap Persists in Latin America.” BuenosAiresHerald.com. N.p., 9 Mar. 2016. Web. 31 Mar. 2017. <http://www.buenosairesherald.com/article/210283/gender-wage-gap-persists-in-latin-america>.

Ibarra, Alicia Barcena, and Winnie Byanyima. “Latin America Is the World’s Most Unequal Region. Here’s How to Fix It.” World Economic Forum. N.p., 17 Jan. 2016. Web. 21 Mar. 2017. <https://www.weforum.org/agenda/2016/01/inequality-is-getting-worse-in-latin-america-here-s-how-to-fix-it/>.

Krugman, Paul, Robin Wells, Margaret Ray, and David Anderson. Krugman’s Economics for AP. Second Edition ed. New York: Worth, 2011. 711+. Print. Economics.

Lustig, Nora, Luis F. Lopez-Calva, and Eduardo Ortiz-Juarez, forthcoming, “Deconstructing the Decline in Inequality in Latin America, in Proceedings of IEA Roundtable on Shared Prosperity and Growth, ed. by Kaushik Basu and Joseph Stiglitz (New York: Palgrave MacMillan).

Meza, Silvia Elena. “Dimensions of Poverty and Inequality in Latin America.” Dimensions of Poverty and Inequality in Latin America – News – A-id: Agenda for International Development. N.p., 9 Nov. 2016. Web. 22 Mar. 2017. <http://www.a-id.org/en/news/dimensions-of-poverty-and-inequality-in-latin-america/>.

Morrison, Judith A. “Behind the Numbers: Race and Ethnicity in Latin America.” Americas Quarterly. N.p., June-July 2015. Web. 31 Mar. 2017. <http://www.americasquarterly.org/content/behind-numbers-race-and-ethnicity-latin-america>.

Morse, Brandon. “Income Inequality Is a Good Thing.” RedState. N.p., 05 Sept. 2016. Web. 31 Mar. 2017. <http://www.redstate.com/brandon_morse/2016/09/05/income-inequality-good-thing/>.

Vermeiren, Mattias, and Wouter Lips. “The Panama Papers and the International Battle Against Tax Havens: Lessons for the EU.” Heinrich Böll Stiftung European Union. N.p., 11 Apr. 2016. Web. 31 Mar. 2017. <https://eu.boell.org/en/2016/04/11/panama-papers-and-international-battle-against-tax-havens-lessons-eu>.

Featured image:Poverty in Latin America – CSR MatchCSR Match